Custom Search

Shopping For Tea in China

After crossing Asia, I discovered that the word for “tea” was the only universally common word across all the major language groups and local dialects on the continent – cha(i). All tea is actually made from the leaves of one plant – Camellia sinensis, but each ethnic group has its own preparation methods and China is no different. So within China, which is a few square miles short of the United States in land area, there are many variations. As a result, buying tea in China can be somewhat of a bewildering experience – but a cultural experience that a visitor must have! Some shops have sales people thrusting Dixie cups filled with tea at you, while other shops are tucked away in anonymous alleys with miscellaneous drums of tea stacked silently along a wall. If you are wary of getting a bad deal, you can head to a Wuyutai – a tea shop chain of sorts that is a well-respected brand in China. It is not just for foreigners; Chinese people definitely shop there too. You won’t find the best prices at Wuyutai, but you will get good service and top-quality product.

If I could give a foreigner three pieces of advice before going tea shopping in China, they would be:

Know the Different Kinds of Teas - People in tea shops don’t speak English (not even at Wuyutai) and I would be wary of those that do have staff who speak English. So it is important to at least know the variety of tea that you are interested in as a starting point. In China, there are seven different varieties of tea – they are:

Lù chá (lue-chah – lue is pronounced like ‘lieu’tenant): Green tea. If you can’t think of what kind of tea you want or want to buy tea as a gift, a safe bet is to ask for xī hú lóng jĭng (shee-hoo-lohng-jean). This was the Dowager Empress’s favorite tea and is a favorite throughout China. The best way to prepare it is to pour water at just-sub-boiling temperatures over the leaves in an uncovered cup. The leaves will unfurl and when they sink to the bottom, the tea is ready to drink. Most Chinese teas and all green teas come in two different forms: míngqían chá (ming-chien-chah) and yŭqían chá (yu-chien-chah). Míngqían chá is the most expensive and is the first picking of the season. Yŭqían chá is less expensive and is from “after the rains” or later in the season. A reasonable price for good quality green tea of the former is about 150 yuan for 50 grams and a reasonable price of the latter is about 40 yuan for 50 grams. Although truth be told, yŭqían chá can have such low prices that it is basically free. If you are going to go for it and buy some míngqían chá, make sure that it is refrigerated or otherwise temperature controlled.

Gōngfu chá (Gong-foo-chah): Ceremonial tea. This type of tea is used for ceremonial purposes (and also casual drinking) in China and Japan. Oolong tea, which is known in China by that name, is the most common kind of tea of this variety.

Heī chá (hey-chah): Black tea. The most common kind is pu-er and in China, it is also known by that name. Objectively speaking, pu-er kind of tastes like subtley-flavored dirty water. So it is an acquired taste and this is coming from someone who likes it.

Hóng chá (hong-chah): Red tea. This tea is found throughout the Middle East. In most places outside of China and Japan, if you are served tea – it is either black or red. Within China and Japan, it is available, but not commonly served.

Baí chá (buy-chah): White tea. Recently popular in the United States, this tea is not very popular in China. You can find it in some stores, but not all. White tea is very subtle. If you aren’t a tea drinker, this tea will always taste like you didn’t put enough leaves in the strainer.

Huáng chá (hwang-chah): Yellow tea. Like white tea, you can find it in China, but it isn’t very popular. The yellow tea that I have tried has been pretty plain, but I do not want to give it a bad reputation. If you have had a yellow tea that you particularly like, please leave me the name in the comments below.

Huā chá (Hwaah-chah): Flower tea. This is the only tea variety that does not come from a tea plant. This variety consists of flowers that are added to water to give flavor. The most common types of flowers are rosebuds (they make for a somewhat bitter tea) and chrysanthemums. While attractive, flower tea is some of the cheapest tea that you can buy, so if you are being quoted a price that seems expensive or along the lines of the average tea – you are being taken.

Don’t Be Afraid to Ask to Try The Teas – Trying the teas is often central to the shopping experience. Shop-keepers will not begrudge you the opportunity to try different teas and indeed, will welcome the opportunity to push you into more expensive categories once they reveal to you the merits of trading up. If you are in a store that seems to have the infrastructure to allow you to sample teas (i.e. not at a counter in a shopping mall) – such as oddly shaped wooden tables that allow water to runoff into one place – ask to try certain teas. The way to ask to try a tea is to say – cháng yī cháng (chahng-ee-chahng) or more properly wŏ kĕyĭ cháng yī cháng (woe kuh-yee chahng-ee-chahng). This question may lead you to be escorted to a seat to try the teas or the response may be – nĭ kĕyĭ kàn yī kàn – which means you can’t try the teas, but you can look at them. If you aren’t permitted to try a tea, don’t be afraid to get up close to the tea and smell it. If you do get a chance to taste the teas, the process will allow you to note the differences between the varieties and to determine whether you can tell the difference between a good tea and a bad tea before you spend $1 per gram on a first-class xī hú lóng jĭng tea. I am always amazed by how much tea is spilled while sampling; it is a sight to see.

Prices Are Not Quoted In The Metric System – The prices quoted on the tea drums will be per 500 grams in the metric system not per kilo. The standard Chinese weight (jīn) is half a kilo. So if you are buying a good tea that costs a 1,000 yuan per the quoted price on the drum – this price corresponds to one jīn. So if you ask for 100 grams (kè), you are actually asking for 20% of a jīn, rather than 10% of a kilo. In other words, you will be buying 200 yuan worth of tea rather than 100 yuan worth. To make things more confusing, the scales used throughout China are on the metric system, so it will show that you are buying 100 grams, but you will be quoted a price that is double what you thought it would be. This is the case from Xinjiang to Shanghai whether you are buying fruit, fish or anything by weight. Understand that this is the case – you aren’t being screwed because you are a foreigner.

While I am usually a voracious bargainer, tea is one area where I usually restrain myself from bargaining. This is particularly the case if I have tried many teas in the shopping process. At places such as Wuyutai, negotiating is not an option and the prices are clearly posted. At a more humble store, where there may be no prices clearly posted, a subtle way of negotiating would be to ask for prices of teas you don’t really want and be silent or look somewhat displeased. And then ask for prices on the teas that you do want. If the prices seem outrageous in comparison to some of those discussed above, you should feel free to walk away.

After crossing Asia, I discovered that the word for “tea” was the only universally common word across all the major language groups and local dialects on the continent – cha(i). All tea is actually made from the leaves of one plant – Camellia sinensis, but each ethnic group has its own preparation methods and China is no different. So within China, which is a few square miles short of the United States in land area, there are many variations. As a result, buying tea in China can be somewhat of a bewildering experience – but a cultural experience that a visitor must have! Some shops have sales people thrusting Dixie cups filled with tea at you, while other shops are tucked away in anonymous alleys with miscellaneous drums of tea stacked silently along a wall. If you are wary of getting a bad deal, you can head to a Wuyutai – a tea shop chain of sorts that is a well-respected brand in China. It is not just for foreigners; Chinese people definitely shop there too. You won’t find the best prices at Wuyutai, but you will get good service and top-quality product.

If I could give a foreigner three pieces of advice before going tea shopping in China, they would be:

Know the Different Kinds of Teas - People in tea shops don’t speak English (not even at Wuyutai) and I would be wary of those that do have staff who speak English. So it is important to at least know the variety of tea that you are interested in as a starting point. In China, there are seven different varieties of tea – they are:

Lù chá (lue-chah – lue is pronounced like ‘lieu’tenant): Green tea. If you can’t think of what kind of tea you want or want to buy tea as a gift, a safe bet is to ask for xī hú lóng jĭng (shee-hoo-lohng-jean). This was the Dowager Empress’s favorite tea and is a favorite throughout China. The best way to prepare it is to pour water at just-sub-boiling temperatures over the leaves in an uncovered cup. The leaves will unfurl and when they sink to the bottom, the tea is ready to drink. Most Chinese teas and all green teas come in two different forms: míngqían chá (ming-chien-chah) and yŭqían chá (yu-chien-chah). Míngqían chá is the most expensive and is the first picking of the season. Yŭqían chá is less expensive and is from “after the rains” or later in the season. A reasonable price for good quality green tea of the former is about 150 yuan for 50 grams and a reasonable price of the latter is about 40 yuan for 50 grams. Although truth be told, yŭqían chá can have such low prices that it is basically free. If you are going to go for it and buy some míngqían chá, make sure that it is refrigerated or otherwise temperature controlled.

Gōngfu chá (Gong-foo-chah): Ceremonial tea. This type of tea is used for ceremonial purposes (and also casual drinking) in China and Japan. Oolong tea, which is known in China by that name, is the most common kind of tea of this variety.

Heī chá (hey-chah): Black tea. The most common kind is pu-er and in China, it is also known by that name. Objectively speaking, pu-er kind of tastes like subtley-flavored dirty water. So it is an acquired taste and this is coming from someone who likes it.

Hóng chá (hong-chah): Red tea. This tea is found throughout the Middle East. In most places outside of China and Japan, if you are served tea – it is either black or red. Within China and Japan, it is available, but not commonly served.

Baí chá (buy-chah): White tea. Recently popular in the United States, this tea is not very popular in China. You can find it in some stores, but not all. White tea is very subtle. If you aren’t a tea drinker, this tea will always taste like you didn’t put enough leaves in the strainer.

Huáng chá (hwang-chah): Yellow tea. Like white tea, you can find it in China, but it isn’t very popular. The yellow tea that I have tried has been pretty plain, but I do not want to give it a bad reputation. If you have had a yellow tea that you particularly like, please leave me the name in the comments below.

Huā chá (Hwaah-chah): Flower tea. This is the only tea variety that does not come from a tea plant. This variety consists of flowers that are added to water to give flavor. The most common types of flowers are rosebuds (they make for a somewhat bitter tea) and chrysanthemums. While attractive, flower tea is some of the cheapest tea that you can buy, so if you are being quoted a price that seems expensive or along the lines of the average tea – you are being taken.

Don’t Be Afraid to Ask to Try The Teas – Trying the teas is often central to the shopping experience. Shop-keepers will not begrudge you the opportunity to try different teas and indeed, will welcome the opportunity to push you into more expensive categories once they reveal to you the merits of trading up. If you are in a store that seems to have the infrastructure to allow you to sample teas (i.e. not at a counter in a shopping mall) – such as oddly shaped wooden tables that allow water to runoff into one place – ask to try certain teas. The way to ask to try a tea is to say – cháng yī cháng (chahng-ee-chahng) or more properly wŏ kĕyĭ cháng yī cháng (woe kuh-yee chahng-ee-chahng). This question may lead you to be escorted to a seat to try the teas or the response may be – nĭ kĕyĭ kàn yī kàn – which means you can’t try the teas, but you can look at them. If you aren’t permitted to try a tea, don’t be afraid to get up close to the tea and smell it. If you do get a chance to taste the teas, the process will allow you to note the differences between the varieties and to determine whether you can tell the difference between a good tea and a bad tea before you spend $1 per gram on a first-class xī hú lóng jĭng tea. I am always amazed by how much tea is spilled while sampling; it is a sight to see.

Prices Are Not Quoted In The Metric System – The prices quoted on the tea drums will be per 500 grams in the metric system not per kilo. The standard Chinese weight (jīn) is half a kilo. So if you are buying a good tea that costs a 1,000 yuan per the quoted price on the drum – this price corresponds to one jīn. So if you ask for 100 grams (kè), you are actually asking for 20% of a jīn, rather than 10% of a kilo. In other words, you will be buying 200 yuan worth of tea rather than 100 yuan worth. To make things more confusing, the scales used throughout China are on the metric system, so it will show that you are buying 100 grams, but you will be quoted a price that is double what you thought it would be. This is the case from Xinjiang to Shanghai whether you are buying fruit, fish or anything by weight. Understand that this is the case – you aren’t being screwed because you are a foreigner.

While I am usually a voracious bargainer, tea is one area where I usually restrain myself from bargaining. This is particularly the case if I have tried many teas in the shopping process. At places such as Wuyutai, negotiating is not an option and the prices are clearly posted. At a more humble store, where there may be no prices clearly posted, a subtle way of negotiating would be to ask for prices of teas you don’t really want and be silent or look somewhat displeased. And then ask for prices on the teas that you do want. If the prices seem outrageous in comparison to some of those discussed above, you should feel free to walk away.

Buying a house in China: The laowai Experience

Mark, 28, China

American metalhead tattoo enthusiast teaching English in China. Loves God, his wife and son, sunshine, and orange soda.

For most Chinese people, owning a home is an extreme priority (though "owning" really means "a 70 year lease from the government.") In the West, owning a homeis a big priority, though not essential. In the Western mentality, houses are for owning, apartments/flats are for renting. And since there are very few houses in China, most Westerners are happy to rent when they come to China to live, even if they're going to be here for a long, long time.

A few months after my wife and I got married in February 2009, we decided it was time to buy a home. I was well aware of the Chinese inclination (read: obsession) with home ownership, and this is actually a valid perspective in China, where distrust and paranoia of being cheated reign supreme, and no one wants a landlord literally lording over you. I was also aware of the huge responsibility and cost that comes with purchasing a home. But we decided to take the plunge nonetheless, and so far, I'm glad we did.

For one thing, it makes my wife very happy, and happy wife=happy life :-). But seriously, women crave stability, particularly in China, and while my wife isn't like the hordes of money-minded materialistic sirens prowling around, having a home to call your own is a big relief.

Another reason is the investment opportunity. We live on Xiamen Island for the time being while we're waiting for our new home to be constructed, but our new home is outside the island, on the mainland. This means its drastically cheaper and quieter than if we had purchased a home on the island. It's still only a 45 minute bus ride and if we get our own car, a 20 minute ride back to the island, which is the hub for Xiamen's shopping, restaurants, and nightlife. There are several shopping centers, parks, etc. around where our new home is, but it's still mostly countryside. But that is actually what we would like, since Xiamen Island is quickly becoming too crowded. Right now, the home we are renting is right next to Zhong Shan Road, Xiamen's top tourist hot spot, and while the convenience is nice, the crowds and traffic is not.

So, back to the investment opportunity. As I said, our new home is waaay cheaper than on the island. It's on the 21st floor, 90 sq. meters, two bedrooms/one bath, looking out to the sea, though there are some industries and businesses around the building, but no smoke stacks or pollution. It's also right across from a yet-to-be-finished bridge that will let me zip over to my university in about 15 minutes. All this for 2990 RMB/sq. meter. That's right. We put down our deposit in May 2009, and already it has appreciated to over 4200 RMB/sq. meter. As I said before, it's still in the countryside, but there are several developments and apartment complexes going up around it, so in the next 3-5 years, that area will probably be a decent suburb of Xiamen.

Now I often have people asking me about the process of buying a house, so let me share my experience. My wife and I are quick decision-makers, and we were lucky enough to find this home that suited us, was in a good location, and had a great price, so we jumped right in. The down payment was a bit of an expense, and we used my wife's savings for that, since I had drank, shopped, and traveled away most of my money in my three previous years in China *looks sheepish.* I chipped in a bit though too. The law stated that if a house is under 90 sq. meters, then the down payment is 20% of the total house value, if over, then it's 30%. Our home came to around 89.40 sq. meters so we just bared squeaked in at the 20% mark.

Getting the loan from the bank was a bit of a nail-biter, since my wife didn't have a job, but we couldn't tell the bank that I, her husband, did have a job and was therefore capable of repaying the bank, since the bank wouldn't give her the loan if they knew that we were married. The reason is that the bank would be naturally squeamish about loaning money to a Chinese person with a foreign spouse, since the couple could easily take the loan, make their purchase, and then zip off to the foreigner's home country, leaving the bank empty-handed. But since my wife also owned a small storefront that she rents out, the bank saw her as low-risk (and still single), so they granted the bank loan to her at a fixed interest rate.

I thought this was interesting but understandable. From what I hear, foreigners can only own one piece of property in China, usually a factory or other business. I'm a teacher, not a businessman, so I don't need to worry about this, but without something significant tying me to China, the bank wouldn't give her the loan, so we needed to keep our marriage under wraps.

So now we've got a ten-year mortgage at a fixed rate, and the payments are quite reasonable, only about 20% of my monthly income. My wife doesn't work (her current job is incubating our little bundle of joy, due to arrive in August). The construction should be finished in July of this year, but all we're really getting is an empty concrete box. We have to take care of all the interior design ourselves, which is what we're saving up for at the moment. We expect to move to our new home by next summer. All in all, it's been a relatively low-stress situation, and I really feel that we got lucky. I would encourage other married foreigners to purchase homes outside of large cities, since urban areas are severely over-priced, though this could change quickly. Suburban homes tend to be quieter, less expensive, and the appreciation will probably be less erratic than city homes.

I think purchasing a home is a good idea, especially if you're going to be in China for the long haul and plan to have a family here. My wife and I expect that we'll stay in China until it's time for our child to begin his/her education, and a Western education is definitely the better choice- can I get an "Amen." But even while we're gone, we can rent our home, and we'll always have a home to come back to.

In unrelated news, I haven't gotten a new tattoo in several months, so I went to the beach and got sunburned to get that peeling and itching feeling that I know and love so well. Just thought I'd share.

American metalhead tattoo enthusiast teaching English in China. Loves God, his wife and son, sunshine, and orange soda.

For most Chinese people, owning a home is an extreme priority (though "owning" really means "a 70 year lease from the government.") In the West, owning a homeis a big priority, though not essential. In the Western mentality, houses are for owning, apartments/flats are for renting. And since there are very few houses in China, most Westerners are happy to rent when they come to China to live, even if they're going to be here for a long, long time.

A few months after my wife and I got married in February 2009, we decided it was time to buy a home. I was well aware of the Chinese inclination (read: obsession) with home ownership, and this is actually a valid perspective in China, where distrust and paranoia of being cheated reign supreme, and no one wants a landlord literally lording over you. I was also aware of the huge responsibility and cost that comes with purchasing a home. But we decided to take the plunge nonetheless, and so far, I'm glad we did.

For one thing, it makes my wife very happy, and happy wife=happy life :-). But seriously, women crave stability, particularly in China, and while my wife isn't like the hordes of money-minded materialistic sirens prowling around, having a home to call your own is a big relief.

Another reason is the investment opportunity. We live on Xiamen Island for the time being while we're waiting for our new home to be constructed, but our new home is outside the island, on the mainland. This means its drastically cheaper and quieter than if we had purchased a home on the island. It's still only a 45 minute bus ride and if we get our own car, a 20 minute ride back to the island, which is the hub for Xiamen's shopping, restaurants, and nightlife. There are several shopping centers, parks, etc. around where our new home is, but it's still mostly countryside. But that is actually what we would like, since Xiamen Island is quickly becoming too crowded. Right now, the home we are renting is right next to Zhong Shan Road, Xiamen's top tourist hot spot, and while the convenience is nice, the crowds and traffic is not.

So, back to the investment opportunity. As I said, our new home is waaay cheaper than on the island. It's on the 21st floor, 90 sq. meters, two bedrooms/one bath, looking out to the sea, though there are some industries and businesses around the building, but no smoke stacks or pollution. It's also right across from a yet-to-be-finished bridge that will let me zip over to my university in about 15 minutes. All this for 2990 RMB/sq. meter. That's right. We put down our deposit in May 2009, and already it has appreciated to over 4200 RMB/sq. meter. As I said before, it's still in the countryside, but there are several developments and apartment complexes going up around it, so in the next 3-5 years, that area will probably be a decent suburb of Xiamen.

Now I often have people asking me about the process of buying a house, so let me share my experience. My wife and I are quick decision-makers, and we were lucky enough to find this home that suited us, was in a good location, and had a great price, so we jumped right in. The down payment was a bit of an expense, and we used my wife's savings for that, since I had drank, shopped, and traveled away most of my money in my three previous years in China *looks sheepish.* I chipped in a bit though too. The law stated that if a house is under 90 sq. meters, then the down payment is 20% of the total house value, if over, then it's 30%. Our home came to around 89.40 sq. meters so we just bared squeaked in at the 20% mark.

Getting the loan from the bank was a bit of a nail-biter, since my wife didn't have a job, but we couldn't tell the bank that I, her husband, did have a job and was therefore capable of repaying the bank, since the bank wouldn't give her the loan if they knew that we were married. The reason is that the bank would be naturally squeamish about loaning money to a Chinese person with a foreign spouse, since the couple could easily take the loan, make their purchase, and then zip off to the foreigner's home country, leaving the bank empty-handed. But since my wife also owned a small storefront that she rents out, the bank saw her as low-risk (and still single), so they granted the bank loan to her at a fixed interest rate.

I thought this was interesting but understandable. From what I hear, foreigners can only own one piece of property in China, usually a factory or other business. I'm a teacher, not a businessman, so I don't need to worry about this, but without something significant tying me to China, the bank wouldn't give her the loan, so we needed to keep our marriage under wraps.

So now we've got a ten-year mortgage at a fixed rate, and the payments are quite reasonable, only about 20% of my monthly income. My wife doesn't work (her current job is incubating our little bundle of joy, due to arrive in August). The construction should be finished in July of this year, but all we're really getting is an empty concrete box. We have to take care of all the interior design ourselves, which is what we're saving up for at the moment. We expect to move to our new home by next summer. All in all, it's been a relatively low-stress situation, and I really feel that we got lucky. I would encourage other married foreigners to purchase homes outside of large cities, since urban areas are severely over-priced, though this could change quickly. Suburban homes tend to be quieter, less expensive, and the appreciation will probably be less erratic than city homes.

I think purchasing a home is a good idea, especially if you're going to be in China for the long haul and plan to have a family here. My wife and I expect that we'll stay in China until it's time for our child to begin his/her education, and a Western education is definitely the better choice- can I get an "Amen." But even while we're gone, we can rent our home, and we'll always have a home to come back to.

In unrelated news, I haven't gotten a new tattoo in several months, so I went to the beach and got sunburned to get that peeling and itching feeling that I know and love so well. Just thought I'd share.

Chinese Dream

Talented foreigners with an eye for opportunity are heading eastward to realize their potential in a wide range of fields, reports Todd Balazovic

While China may have once been a favored destination for expats seeking exotic experiences such as teaching English or learning Chinese, an increasing number of people are flocking eastward to realize their dreams. As the Chinese economy continues to grow, success is flourishing not only for entrepreneurial Chinese, but also for foreign residents with an eye for opportunity. This is the story of some of those intrepid foreigners who have shared in the "China dream" - the philanthropist, the actress, the restaurateur and the playwright.

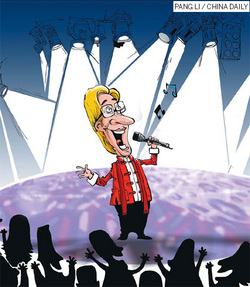

For Charlotte Macinnis, also known as Ai Hua when she is hosting the China Central Television (CCTV) program Growing up with Chinese, the "China dream" started as a child when her family moved to the city of Nanjing to follow her father's career in publishing.

In 1988 at the age of 7, Macinnis was pushed out of a comfortable life in the United States and placed in a land that, at the time, few people in the West knew anything about.

"We didn't have the option of living a Western lifestyle in China, so we adopted a Chinese one," the 30-year-old actress said.

Gaining high proficiency in Mandarin after just two years in a Chinese middle school, Macinnis and her sister Mika began making a local name for themselves as the only expat performers to share the stage with China's well-known Little Red Flowers performing troupe.

After more than a decade in China, Macinnis returned to the US to attend Columbia University where her quirky Chinese mannerisms earned her the nickname "weird white Chinese girl" among her classmates, a title that sticks to this day.

Now, Macinnis is a recognized face in many Beijing households as the host of several programs on CCTV and a regular guest on Chinese talk shows.

"This is exactly where I want to be," she said. "I wouldn't know life anywhere else."

While her opportunity came at a young age, when there was still "an element of wow associated with being a foreigner", Macinnis said China is still teeming with possibilities for those looking to realize their dreams in showbiz.

"Definitely in entertainment there's a better chance at getting somewhere or being on TV here than you would in the United States," she said, adding that while many opportunities remain available for foreigners, employers are gradually getting more stringent regarding who they hire.

"But the caliber of people coming to China has risen, people are expecting more now. And that's good, that's what it should be."

For some the "China dream" is not about realizing their own potential, but instead about helping others realize theirs.

Tom Stader, founder of the Library Project, a Xi'an-based non-governmental organization that donates libraries to poor rural schools, first came to China as a marketer for an English-language school in the northeastern city of Dalian, Liaoning province.

Following two years working in Dalian, Stader's life took a dramatic shift after he was charged with finding a charity for the school to participate in as part of its corporate responsibility program.

The 36-year-old American responded by putting a plan into motion to host a book drive that would bring learning materials to a Dalian orphanage, where literature was scarce.

The public's response to the fundraiser was overwhelming, bringing in more than 3,400 yuan ($518) and 600 books over the course of just two days.

Seeing the good he could do for those in need, Stader left the school and began the project which has grown into a massive organization that has donated hundreds of libraries across 21 provinces in China.

"I started this organization with $500 and a couple of friends. Building an organization over years from the ground up has really been a dream come true," Stader said.

He attributes his success to China's warm reception for those with good intentions, as well as the relatively cheap startup costs for businesses.

"The barrier of entry in China is quite small if you look at it in business terms, you don't have to have a lot of money to start something big here," he said.

"We did it slow, we did it grassroots, we showed results, we took risks and those risks played out in a very positive manner."

Stader said if he had remained in the US, the chances that he would have been able to start an NGO would have been quite slim due to the overabundance of organizations already operating there.

"It comes down to the need. There are great organizations already on the ground in the US, I am not sure we'd have been able to provide the impact there that we can here," he said.

It was seeing the need in an untapped market that led Briton Will Yorke, owner of the Vineyard Caf, one of Beijing's up and coming Western restaurants, to venture from life as a club DJ to being a respected business owner in a budding Beijing hutong.

Coming to China in 1997 to study Chinese, Yorke was among the first of the city's expats to bring the electronic art of disc jockeying to the capital, earning him a minor celebrity status in the city's club scene.

After finishing his studies and exploring a variety of jobs, including running a kungfu school, the 35-year-old eventually tapped into his experiences working in restaurants as a youth and found himself in the unlikely position of being a restaurant owner.

"It was a mixture of sheer brilliance and a number of random events that kind of led to this end result," he said.

"It was never my intention to open a restaurant in Beijing, I never thought this is what I'd be doing."

The Vineyard, in Beijing's quickly developing Wudaoying Hutong, was the first Western enterprise to open in the area, catalyzing a boom in boutique businesses along the old alley.

Yorke attributes his success to the fact that China is still a relatively young market for Western concepts.

"It's a matter of saturation, the market isn't as saturated as it is in London. You can still take an idea that might be quite old in the UK and make it quite new here," he said.

Though the "eastern front" may be a ripe market for ideas considered commonplace back home, Yorke admits that this was not what he had in mind when he found himself in the restaurant business.

"It was a series of random circumstances that led me here. I didn't consciously do that, I didn't do it like that. I just opened a restaurant and cooked the food I liked," he said.

While meeting success in China may come by chance for some, for American Elyse Ribbons, a host for China Radio International and a resident of China for almost a decade, the "China dream" is for young professionals seeking a unique early-career experience and willing to push themselves with hard work.

The 30-year-old first came to Beijing in 2001 following a trip with classmates from the University of North Carolina. Though at the time she aspired to work for the US State Department using her language skills in Arabic, China's charm won her over and, after finishing her Chinese-language degree in the US, she was determined to return.

"All of us, myself included, fell in love with Beijing and China," she said.

After returning to China in 2002 intending to study traditional Chinese medicine in order to use her skills in the West, Ribbons quickly realized that the medical field was not for her and began experimenting with the varying job opportunities Beijing had to offer, from English teaching to working as a translator for the American Center for Disease Control in Beijing.

Ribbons finally found her niche in the theater in 2006 after spending three weeks in Paris writing her own screenplay I Heart Beijing examining the social stereotypes of foreigners and Chinese in China.

Following the success of her play, Ribbons established herself in the capital's drama scene and has since put on six more productions.

She said while China may offer expats a quicker chance of success than in the West, the room for career growth, especially in the theater, is often limited.

"There's more opportunity in China to get your foot in the door, but once your foot's in getting the rest of your body through is difficult," Ribbons said.

"You've got to be stubborn and have perseverance, that's how you push yourself through the door."

She said while expats in China may be given unique chances, such as playing the role of a TV host simply based on the fact that they're foreign, the opportunities often have little room for advancement.

"You get the introductory opportunities, but to break through the glass ceiling takes a lot of work," she said. .

For Charlotte Macinnis, also known as Ai Hua when she is hosting the China Central Television (CCTV) program Growing up with Chinese, the "China dream" started as a child when her family moved to the city of Nanjing to follow her father's career in publishing.

In 1988 at the age of 7, Macinnis was pushed out of a comfortable life in the United States and placed in a land that, at the time, few people in the West knew anything about.

"We didn't have the option of living a Western lifestyle in China, so we adopted a Chinese one," the 30-year-old actress said.

Gaining high proficiency in Mandarin after just two years in a Chinese middle school, Macinnis and her sister Mika began making a local name for themselves as the only expat performers to share the stage with China's well-known Little Red Flowers performing troupe.

After more than a decade in China, Macinnis returned to the US to attend Columbia University where her quirky Chinese mannerisms earned her the nickname "weird white Chinese girl" among her classmates, a title that sticks to this day.

Now, Macinnis is a recognized face in many Beijing households as the host of several programs on CCTV and a regular guest on Chinese talk shows.

"This is exactly where I want to be," she said. "I wouldn't know life anywhere else."

While her opportunity came at a young age, when there was still "an element of wow associated with being a foreigner", Macinnis said China is still teeming with possibilities for those looking to realize their dreams in showbiz.

"Definitely in entertainment there's a better chance at getting somewhere or being on TV here than you would in the United States," she said, adding that while many opportunities remain available for foreigners, employers are gradually getting more stringent regarding who they hire.

"But the caliber of people coming to China has risen, people are expecting more now. And that's good, that's what it should be."

For some the "China dream" is not about realizing their own potential, but instead about helping others realize theirs.

Tom Stader, founder of the Library Project, a Xi'an-based non-governmental organization that donates libraries to poor rural schools, first came to China as a marketer for an English-language school in the northeastern city of Dalian, Liaoning province.

Following two years working in Dalian, Stader's life took a dramatic shift after he was charged with finding a charity for the school to participate in as part of its corporate responsibility program.

The 36-year-old American responded by putting a plan into motion to host a book drive that would bring learning materials to a Dalian orphanage, where literature was scarce.

The public's response to the fundraiser was overwhelming, bringing in more than 3,400 yuan ($518) and 600 books over the course of just two days.

Seeing the good he could do for those in need, Stader left the school and began the project which has grown into a massive organization that has donated hundreds of libraries across 21 provinces in China.

"I started this organization with $500 and a couple of friends. Building an organization over years from the ground up has really been a dream come true," Stader said.

He attributes his success to China's warm reception for those with good intentions, as well as the relatively cheap startup costs for businesses.

"The barrier of entry in China is quite small if you look at it in business terms, you don't have to have a lot of money to start something big here," he said.

"We did it slow, we did it grassroots, we showed results, we took risks and those risks played out in a very positive manner."

Stader said if he had remained in the US, the chances that he would have been able to start an NGO would have been quite slim due to the overabundance of organizations already operating there.

"It comes down to the need. There are great organizations already on the ground in the US, I am not sure we'd have been able to provide the impact there that we can here," he said.

It was seeing the need in an untapped market that led Briton Will Yorke, owner of the Vineyard Caf, one of Beijing's up and coming Western restaurants, to venture from life as a club DJ to being a respected business owner in a budding Beijing hutong.

Coming to China in 1997 to study Chinese, Yorke was among the first of the city's expats to bring the electronic art of disc jockeying to the capital, earning him a minor celebrity status in the city's club scene.

After finishing his studies and exploring a variety of jobs, including running a kungfu school, the 35-year-old eventually tapped into his experiences working in restaurants as a youth and found himself in the unlikely position of being a restaurant owner.

"It was a mixture of sheer brilliance and a number of random events that kind of led to this end result," he said.

"It was never my intention to open a restaurant in Beijing, I never thought this is what I'd be doing."

The Vineyard, in Beijing's quickly developing Wudaoying Hutong, was the first Western enterprise to open in the area, catalyzing a boom in boutique businesses along the old alley.

Yorke attributes his success to the fact that China is still a relatively young market for Western concepts.

"It's a matter of saturation, the market isn't as saturated as it is in London. You can still take an idea that might be quite old in the UK and make it quite new here," he said.

Though the "eastern front" may be a ripe market for ideas considered commonplace back home, Yorke admits that this was not what he had in mind when he found himself in the restaurant business.

"It was a series of random circumstances that led me here. I didn't consciously do that, I didn't do it like that. I just opened a restaurant and cooked the food I liked," he said.

While meeting success in China may come by chance for some, for American Elyse Ribbons, a host for China Radio International and a resident of China for almost a decade, the "China dream" is for young professionals seeking a unique early-career experience and willing to push themselves with hard work.

The 30-year-old first came to Beijing in 2001 following a trip with classmates from the University of North Carolina. Though at the time she aspired to work for the US State Department using her language skills in Arabic, China's charm won her over and, after finishing her Chinese-language degree in the US, she was determined to return.

"All of us, myself included, fell in love with Beijing and China," she said.

After returning to China in 2002 intending to study traditional Chinese medicine in order to use her skills in the West, Ribbons quickly realized that the medical field was not for her and began experimenting with the varying job opportunities Beijing had to offer, from English teaching to working as a translator for the American Center for Disease Control in Beijing.

Ribbons finally found her niche in the theater in 2006 after spending three weeks in Paris writing her own screenplay I Heart Beijing examining the social stereotypes of foreigners and Chinese in China.

Following the success of her play, Ribbons established herself in the capital's drama scene and has since put on six more productions.

She said while China may offer expats a quicker chance of success than in the West, the room for career growth, especially in the theater, is often limited.

"There's more opportunity in China to get your foot in the door, but once your foot's in getting the rest of your body through is difficult," Ribbons said.

"You've got to be stubborn and have perseverance, that's how you push yourself through the door."

She said while expats in China may be given unique chances, such as playing the role of a TV host simply based on the fact that they're foreign, the opportunities often have little room for advancement.

"You get the introductory opportunities, but to break through the glass ceiling takes a lot of work," she said. .

Foreigners difficult to buy house in China

Buying a house in the city you adopt is a major commitment. In China, that decision may embroil you in situations you never imagined. Shi Yingying examines the pros and cons.

While local residents complain about escalating property prices from Guangzhou to Beijing, the comparative value for money still tempts foreign investors, especially those who have lived and worked in Chinese cities for a long time. With China's growing importance as a major international financial power coupled with the property boom post-Olympics and post-World Expo, more and more foreign buyers are considering riding on the dragon's tail. What holds them back, however, is the bizarre paperwork, the obscurity of the Chinese real estate market and ever-changing regulations and controls.

"Those not really committed simply avoid the mess and just rent," said American David Sutton, who has gone through the process of buying and selling properties in Shanghai and Sanya in Hainan. "Foreigners who buy here are more committed to China and they believe it is worth taking the risk."

But for those who are unfamiliar with the minefields in real estate, they may end up getting into trouble, like Christopher Palmer did.Palmer had already put a down payment on his Baoshan property in 2008 and completed all the necessary paperwork. But, the bank refused to complete the transaction for the mortgage because it said Palmer did not have the proper visa. He was on an L or tourist visa.

"They sprung this on me after I had signed the contracts," said the 35-year-old American who works as an English teacher in Shanghai.

"I understand they want to make sure I will stick around but they had seen all the visas and they knew I had been here for several years, and would not be leaving anytime soon."

While Palmer's frustration is understandable, his story emphasizes the importance of doing enough homework before commitment. The expatriate wanting to put down roots must meet one fundamental principle.

"They must have lived in the city on a residence permit (known as the Z visa) for more than one year ahead of the date of purchase, according to the Opinions on Regulating the Access to and Administration of Foreign Investment in the Real Estate Market (Decree No 171) issued in 2006," says Liu Si from the Real Estate Trading Center in Luwan district.

Related legal documents must also be submitted. These include the work contract, work permit or the proof of one's status as student. All these also need to be notarized, if they are not already in Chinese.

"Imagine a foreigner coming into your country with the intention of buying an apartment with only a tourist visa. Do you think it should be allowed?" Liu says. "This is China, and if you want to buy a property here, you have to follow the proper procedures."

There may be other restrictions, depending on the city. In Shanghai and Beijing, foreigners are only allowed one residential property each.

"The property is to be used for living in and buyers here are required to sign a letter of commitment, stating they wouldn't buy more, with the signatures of their official Chinese names (this can be arranged at the notary office if expatriates don't have one) on the paper," says Liu.

At least property buyers in Shanghai and Beijing can refer to the set of guidelines. Expatriates in Sanya are less lucky.

"The lack of standard, consistent information is a major problem, especially in Sanya. It seems to be very arbitrary," says David Sutton who bought a 209-square-meter ocean-view apartment and had an unpleasant encounter with the local real estate agency.

"Sanya is an outlaw frontier," says Sutton. " I found that the real estate agents' main concern was how to make the most money. They do not serve as advocates for their clients, neither buyer or seller and they are looking out only for themselves. Don't even think of getting into this process without some help of a Chinese friend whom you trust."

Once a buyer is past the initial hurdles and all the papers are delivered, it usually takes another 45 to 90 days to get the process completed. In Beijing, property agents say it normally takes 30 days to get the process completed. If buyers pay off the whole sum at once, the process may take just seven days.

"It is so much easier than in Western countries. I am a European and it took me less than a week to do all the paperwork once I decided to buy my place," says 33-year-old Spanish Mark Larsen who bought a one-bedroom apartment in Xin Zhuang.

"Limit your choice of locations and find a trusty agent," says Yan Ai, who started looking at apartments around Jing'an district last August with her German husband.

Some of the more popular areas that attract foreigners in Shanghai are centralized around Xin Tiandi, Lu Jiazui, Gu Bei and Lian Yang, according to Howard Zhang from Crispins Property Investment.

For Beijing property buyers, high-end apartments in Chaoyang district or luxury villas in Shunyi are preferred by expatriates, says Wang Xiangjing, general manager of Century Realty.

There are a number of real estate companies who specialize in helping expatriates but they may charge more.

The average commission for completing a sale is around one percent of the property price in Shanghai, but Beijing property agents normally charge three percent, which is the upper limit regulated by law. For those who can speak Chinese, a smaller or local real estate agency chain is more affordable. If in doubt, ask a Chinese friend for advice.

After making an offer, the owner and buyer will sign a stamped sales contract. Armed with this piece of paper, foreign buyers can then start shopping around for the best mortgage deals. Loans are available to foreigners from large Chinese banks such as Bank of China, China Construction Bank and international banks such as HSBC and Standard Chartered.

"Expatriates actually enjoy certain advantages in terms of applying for the loans as certain international banks will not consider lending money to Chinese," said Howard Zhang from Crispins.

Once the loan is finalized, all the necessary documents are checked once more by both the agent and the bank. If everything is in order, buyer and seller can then proceed to the district property trading center to transfer the name on the title deed.

And once the name is on the deed, the happy expatriate will have successfully cleared all the hurdles and would now join the ranks of proud owners hanging on to the fastest appreciating pieces of real estate in the world.

While local residents complain about escalating property prices from Guangzhou to Beijing, the comparative value for money still tempts foreign investors, especially those who have lived and worked in Chinese cities for a long time. With China's growing importance as a major international financial power coupled with the property boom post-Olympics and post-World Expo, more and more foreign buyers are considering riding on the dragon's tail. What holds them back, however, is the bizarre paperwork, the obscurity of the Chinese real estate market and ever-changing regulations and controls.

"Those not really committed simply avoid the mess and just rent," said American David Sutton, who has gone through the process of buying and selling properties in Shanghai and Sanya in Hainan. "Foreigners who buy here are more committed to China and they believe it is worth taking the risk."

But for those who are unfamiliar with the minefields in real estate, they may end up getting into trouble, like Christopher Palmer did.Palmer had already put a down payment on his Baoshan property in 2008 and completed all the necessary paperwork. But, the bank refused to complete the transaction for the mortgage because it said Palmer did not have the proper visa. He was on an L or tourist visa.

"They sprung this on me after I had signed the contracts," said the 35-year-old American who works as an English teacher in Shanghai.

"I understand they want to make sure I will stick around but they had seen all the visas and they knew I had been here for several years, and would not be leaving anytime soon."

While Palmer's frustration is understandable, his story emphasizes the importance of doing enough homework before commitment. The expatriate wanting to put down roots must meet one fundamental principle.

"They must have lived in the city on a residence permit (known as the Z visa) for more than one year ahead of the date of purchase, according to the Opinions on Regulating the Access to and Administration of Foreign Investment in the Real Estate Market (Decree No 171) issued in 2006," says Liu Si from the Real Estate Trading Center in Luwan district.

Related legal documents must also be submitted. These include the work contract, work permit or the proof of one's status as student. All these also need to be notarized, if they are not already in Chinese.

"Imagine a foreigner coming into your country with the intention of buying an apartment with only a tourist visa. Do you think it should be allowed?" Liu says. "This is China, and if you want to buy a property here, you have to follow the proper procedures."

There may be other restrictions, depending on the city. In Shanghai and Beijing, foreigners are only allowed one residential property each.

"The property is to be used for living in and buyers here are required to sign a letter of commitment, stating they wouldn't buy more, with the signatures of their official Chinese names (this can be arranged at the notary office if expatriates don't have one) on the paper," says Liu.

At least property buyers in Shanghai and Beijing can refer to the set of guidelines. Expatriates in Sanya are less lucky.

"The lack of standard, consistent information is a major problem, especially in Sanya. It seems to be very arbitrary," says David Sutton who bought a 209-square-meter ocean-view apartment and had an unpleasant encounter with the local real estate agency.

"Sanya is an outlaw frontier," says Sutton. " I found that the real estate agents' main concern was how to make the most money. They do not serve as advocates for their clients, neither buyer or seller and they are looking out only for themselves. Don't even think of getting into this process without some help of a Chinese friend whom you trust."

Once a buyer is past the initial hurdles and all the papers are delivered, it usually takes another 45 to 90 days to get the process completed. In Beijing, property agents say it normally takes 30 days to get the process completed. If buyers pay off the whole sum at once, the process may take just seven days.

"It is so much easier than in Western countries. I am a European and it took me less than a week to do all the paperwork once I decided to buy my place," says 33-year-old Spanish Mark Larsen who bought a one-bedroom apartment in Xin Zhuang.

"Limit your choice of locations and find a trusty agent," says Yan Ai, who started looking at apartments around Jing'an district last August with her German husband.

Some of the more popular areas that attract foreigners in Shanghai are centralized around Xin Tiandi, Lu Jiazui, Gu Bei and Lian Yang, according to Howard Zhang from Crispins Property Investment.

For Beijing property buyers, high-end apartments in Chaoyang district or luxury villas in Shunyi are preferred by expatriates, says Wang Xiangjing, general manager of Century Realty.

There are a number of real estate companies who specialize in helping expatriates but they may charge more.

The average commission for completing a sale is around one percent of the property price in Shanghai, but Beijing property agents normally charge three percent, which is the upper limit regulated by law. For those who can speak Chinese, a smaller or local real estate agency chain is more affordable. If in doubt, ask a Chinese friend for advice.

After making an offer, the owner and buyer will sign a stamped sales contract. Armed with this piece of paper, foreign buyers can then start shopping around for the best mortgage deals. Loans are available to foreigners from large Chinese banks such as Bank of China, China Construction Bank and international banks such as HSBC and Standard Chartered.

"Expatriates actually enjoy certain advantages in terms of applying for the loans as certain international banks will not consider lending money to Chinese," said Howard Zhang from Crispins.

Once the loan is finalized, all the necessary documents are checked once more by both the agent and the bank. If everything is in order, buyer and seller can then proceed to the district property trading center to transfer the name on the title deed.

And once the name is on the deed, the happy expatriate will have successfully cleared all the hurdles and would now join the ranks of proud owners hanging on to the fastest appreciating pieces of real estate in the world.

In China, Money Can Often Buy Love

by New York Times

BEIJING — Money really can buy you love in China — or at least that seems to be a common belief in this increasingly materialistic country.

Many personal stories seem to confirm that the ideal mate is the one who can deliver a home and a car, among other things; sentiment is secondary.

However widespread this mercantilist spirit, not everyone thinks it is a good thing. A spate of Chinese films, plays and television shows have raised the question: What is love in an age of breakneck economic growth?

Many Chinese were shocked this year when a female contestant on a popular TV dating show, “If You Are the One,” announced: “I’d rather cry in a BMW than smile on a bicycle.” But others insisted that the contestant, Ma Nuo, now popularly known as “the BMW woman,” was merely expressing a social reality.

Rocketing property prices in recent years have contributed to such feelings, with many people in Beijing and other cities accepting the idea that a woman will pursue a relationship with a man only if he already owns an apartment.

Feng Yuan, a 26-year-old who works in a government education company, tried to set up a friend with a man she thought suitable.

“When she heard he didn’t own an apartment, she refused even to meet him,” recalled Ms. Feng. “She said, ‘What’s the point? Without an apartment, love isn’t possible.”’

Fueling these attitudes is a drumbeat of fear. After three decades of fast-paced, uneven economic growth, there is enormous anxiety among those who feel they are being left behind, lacking the opportunities and contacts to make big money while all around them others prosper and prices soar.

The new creed can be hard, as a 26-year-old cultural events organizer learned.

The man, who asked for anonymity to protect his privacy, earns about 4,000 renminbi, or $600, a month, making even a modest apartment in an unfashionable district of Beijing unaffordable. These homes can cost about $3,000 per square meter, or about $280 per square foot. Housing inflation is severe. Ten years ago, a similar apartment cost about $345 per square meter.

Instead, he tried to impress his girlfriend of three years by saving for a year to buy an iPhone 3. The newer iPhone 4 — a hot status symbol — had just gone on sale. But at about $900, that was beyond his means.

The phone was not enough. Last week, she left him, citing pressure from her parents to find a richer mate.

He is heartbroken, believing, despite all, that his girlfriend truly loved him. “Why else did she live with me for three years?” — albeit in a rented apartment. Yet, he is philosophical, too.

“I understand her situation and the pressure from her family,” he said. “I also understand that her parents want their daughter to find someone who can give her a better life.”

The only way to find love, he said, is to become rich. “The most important thing for me now, is to work and earn a living.” he said. “I need to grow stronger, support myself and my parents, and then my future girlfriend can have a good life.”

Such calculations have their critics. The hard-nosed attitude of Ms. Ma, the BMW woman, earned her a gentle reprimand recently from the film director Zhang Yimou. In an interview in The South China Morning Post, a Hong Kong newspaper, he urged young people to re-examine their values.

“I don’t think economic advancement and our yearning for love are mutually exclusive,” he said.

Mr. Zhang, who turns 59 on Sunday, represents an older generation that remembers the more egalitarian, if also poorer and more politically repressive, Maoist era, before the economic changes that unleashed the scramble for material advancement.

His latest film, “Under the Hawthorn Tree,” depicts the innocent love between a teacher, Jing Qiu, and a geologist, Lao San. Set in 1975 toward the end of the Cultural Revolution, and without a BMW in sight, the film shows the teacher spending quite a lot of time smiling on her sweetheart’s bicycle. Love is the thing, it concludes.

Other productions have joined the debate.

“Fight the Landlord,” a play by Sun Yue that premiered in Shanghai last month, is another ringing defense of love in an age of materialism.

A character known as B, grilled by a potential mother-in-law about her very ordinary income, yells: “Don’t think that because I have nothing to be proud of you can insult and destroy me!”

“I have my dignity and pride,” B says, “and I don’t want to turn love, which I value so much, into something vulgar and pale!”

A new film, “Color Me Love,” celebrates the cult of materialism but also comes down, somewhat, on the side of love. Modeled on “The Devil Wears Prada,” and with product placement for Hermès, Versace and Diesel, it follows poor but gorgeous Fei as she arrives in Beijing to intern at a fashion magazine.

“Fei, one day you’ll understand,” Zoe, her glamorous editor, cautions her. “Nothing is as important as the person you’ll spend the rest of your life with.”

A tumultuous courtship with a wacky artist named Yihong ends up with the couple united in New York. A closing shot shows her in his arms, a diamond on her finger. The real fantasy, perhaps, is love plus money.

Ms. Feng, who had failed to find a match for her apartmentless friend, said the demands that many Chinese women make on prospective mates reflected weakness, not power. Lower in status, they fear not getting what they want in life, and look to men to provide it.

“Women are very dependent,” she said. “I blame them. Why can’t they work hard and buy a house together with their man? But very few women today think like that.”

Few Chinese men do either, reinforcing the rules of the game. For the 26-year-old events organizer, losing his love to money was justifiable.

“We didn’t need to waste time on a relationship that was doomed to vanish,” he said.

Many personal stories seem to confirm that the ideal mate is the one who can deliver a home and a car, among other things; sentiment is secondary.

However widespread this mercantilist spirit, not everyone thinks it is a good thing. A spate of Chinese films, plays and television shows have raised the question: What is love in an age of breakneck economic growth?

Many Chinese were shocked this year when a female contestant on a popular TV dating show, “If You Are the One,” announced: “I’d rather cry in a BMW than smile on a bicycle.” But others insisted that the contestant, Ma Nuo, now popularly known as “the BMW woman,” was merely expressing a social reality.

Rocketing property prices in recent years have contributed to such feelings, with many people in Beijing and other cities accepting the idea that a woman will pursue a relationship with a man only if he already owns an apartment.

Feng Yuan, a 26-year-old who works in a government education company, tried to set up a friend with a man she thought suitable.

“When she heard he didn’t own an apartment, she refused even to meet him,” recalled Ms. Feng. “She said, ‘What’s the point? Without an apartment, love isn’t possible.”’

Fueling these attitudes is a drumbeat of fear. After three decades of fast-paced, uneven economic growth, there is enormous anxiety among those who feel they are being left behind, lacking the opportunities and contacts to make big money while all around them others prosper and prices soar.

The new creed can be hard, as a 26-year-old cultural events organizer learned.

The man, who asked for anonymity to protect his privacy, earns about 4,000 renminbi, or $600, a month, making even a modest apartment in an unfashionable district of Beijing unaffordable. These homes can cost about $3,000 per square meter, or about $280 per square foot. Housing inflation is severe. Ten years ago, a similar apartment cost about $345 per square meter.

Instead, he tried to impress his girlfriend of three years by saving for a year to buy an iPhone 3. The newer iPhone 4 — a hot status symbol — had just gone on sale. But at about $900, that was beyond his means.

The phone was not enough. Last week, she left him, citing pressure from her parents to find a richer mate.

He is heartbroken, believing, despite all, that his girlfriend truly loved him. “Why else did she live with me for three years?” — albeit in a rented apartment. Yet, he is philosophical, too.

“I understand her situation and the pressure from her family,” he said. “I also understand that her parents want their daughter to find someone who can give her a better life.”

The only way to find love, he said, is to become rich. “The most important thing for me now, is to work and earn a living.” he said. “I need to grow stronger, support myself and my parents, and then my future girlfriend can have a good life.”

Such calculations have their critics. The hard-nosed attitude of Ms. Ma, the BMW woman, earned her a gentle reprimand recently from the film director Zhang Yimou. In an interview in The South China Morning Post, a Hong Kong newspaper, he urged young people to re-examine their values.

“I don’t think economic advancement and our yearning for love are mutually exclusive,” he said.

Mr. Zhang, who turns 59 on Sunday, represents an older generation that remembers the more egalitarian, if also poorer and more politically repressive, Maoist era, before the economic changes that unleashed the scramble for material advancement.

His latest film, “Under the Hawthorn Tree,” depicts the innocent love between a teacher, Jing Qiu, and a geologist, Lao San. Set in 1975 toward the end of the Cultural Revolution, and without a BMW in sight, the film shows the teacher spending quite a lot of time smiling on her sweetheart’s bicycle. Love is the thing, it concludes.

Other productions have joined the debate.

“Fight the Landlord,” a play by Sun Yue that premiered in Shanghai last month, is another ringing defense of love in an age of materialism.

A character known as B, grilled by a potential mother-in-law about her very ordinary income, yells: “Don’t think that because I have nothing to be proud of you can insult and destroy me!”

“I have my dignity and pride,” B says, “and I don’t want to turn love, which I value so much, into something vulgar and pale!”

A new film, “Color Me Love,” celebrates the cult of materialism but also comes down, somewhat, on the side of love. Modeled on “The Devil Wears Prada,” and with product placement for Hermès, Versace and Diesel, it follows poor but gorgeous Fei as she arrives in Beijing to intern at a fashion magazine.

“Fei, one day you’ll understand,” Zoe, her glamorous editor, cautions her. “Nothing is as important as the person you’ll spend the rest of your life with.”

A tumultuous courtship with a wacky artist named Yihong ends up with the couple united in New York. A closing shot shows her in his arms, a diamond on her finger. The real fantasy, perhaps, is love plus money.

Ms. Feng, who had failed to find a match for her apartmentless friend, said the demands that many Chinese women make on prospective mates reflected weakness, not power. Lower in status, they fear not getting what they want in life, and look to men to provide it.

“Women are very dependent,” she said. “I blame them. Why can’t they work hard and buy a house together with their man? But very few women today think like that.”

Few Chinese men do either, reinforcing the rules of the game. For the 26-year-old events organizer, losing his love to money was justifiable.

“We didn’t need to waste time on a relationship that was doomed to vanish,” he said.

Laura A. Williams, Ann Veeck (1998), "AN EXPLORATORY STUDY OF CHILDREN’S PURCHASE INFLUENCE IN URBAN CHINA", in Asia Pacific Advances in Consumer Research Volume 3, eds. Kineta Hung and Kent B. Monroe, Provo, UT : Association for Consumer Research, Pages: 13-19. Asia Pacific Advances in Consumer Research Volume 3 , 1998 Pages 13-19

AN EXPLORATORY STUDY OF CHILDREN’S PURCHASE INFLUENCE IN URBAN CHINA

Laura A. Williams , San Diego State University, U.S.A.

Ann Veeck , Louisiana State University, U.S.A.

ABSTRACT -

The one-child policy in the People’s Republic of China has created a generation of only children in many urban areas. Popularly called xiao huang di, or little emperors, these only children are widely believed to be an important market force. For this reason, urban China offers a unique environment in which to study the influence of children in family purchase decision-making. The objective of this study is to explore to what extent U.S. findings related to the purchase influence of children are applicable in the newly emerging market economies of urban China. To this end, research propositions are developed and preliminary results from a study of food consumption activities are presented.

INTRODUCTION

In the late 1970’s in the People’s Republic of China, two radical sets of policies were initiated, each with dramatic, nation-transforming results. The first was the wide-sweeping economic reforms that have opened the Chinese economy to the outside world and led to a remarkable growth in GNP, averaging near 10% annually in the last fifteen years. The second was the draconian population control measures that, while showing very recent signs of relaxation (Kahn 1997), have led to a generation of urban dwellers growing up as only children.

While numerous interesting outcomes are associated with each of these sets of policies, the interaction of these effects has led to a particularly intriguing phenomenon. Stated plainly, precisely when Chinese adults are suddenly experiencing a new environment of consumption choice and are enjoying increased spending power, 50 million urban Chinese children are growing up in the singular position to enjoy the benefits of a consumer culture, with no siblings to compete for the spoils. Popularly called xiao huang di, or little emperors, these only children are widely believed to be spoiled by doting parents, grandparents, other relatives, and friends (Goll 1995; Johnstone 1996). Hoping to reap the benefits of this phenomenon, many manufacturers and retailers, both Chinese and international, are zeroing in on urban children, targeting youngsters with a large assortment of goods and services, from Sesame Street (Tung 1997) to Wahaha nutritional drinks (Kaye 1993) to Barbie dolls (Parker-Pope and Bannon 1997).

Indeed, there is evidence that a large proportion of the spending money of urban Chinese families is allocated to expenses associated with their children, with estimates hovering near 50% (Davis and Sensenbrenner 1999; Xi 1996). But, to what extent the popularly-believed myth that these spoiled children hold their parents’ pocketbooks in their hands holds true is unclear. There is some evidence that parents’ sensibilities may prevail over the selfish desires of children. The presence of strong family values that place a high priority on children’s educational and physical development may lead to parents being much more willing to spend money on products that enhance their offsprings’ education and health rather than on those that are coveted by their children (Chu and Ju 1993; Davis and Sensenbrenner 1999; Scary 1996). Altogether, there remains a need to examine the extent and in what ways urban Chinese children influence their families’ spending patterns.

Given this backdrop, urban China offers a unique environment in which to study the influence of children in family purchase decision-making. Largely investigated in the U.S., this area of research would benefit greatly from the additional understanding of cross-national nuances. One important study by McNeal and Ji (1996) of 626 urban Chinese households suggested that urban Chinese children may have the highest purchasing influence in the world, pointing to the need for further investigation as to how and why Chinese children exert these influences.

The objective of this study is the explore to what extent U.S. findings related to the purchase influence of children are applicable in the newly emerging market economies of urban China. To do so, the paper will proceed as follows. First, using the research conducted to date on American children as a framework, a number of propositions related to the purchase influence of urban Chinese children will be developed. Then, the verity of the propositions will be examined for consistency with the findings of preliminary data collected on food consumption behaviors in urban China. It is hoped that this research will begin to uncover similarities and differences between American and urban Chinese children’s influence on purchase decisions.

LITERATURE REVIEW AND RESEARCH PROPOSITION DEVELOPMENT

Research on the influence of American children in family purchase decision-making dates back to the 1960s when Berey and Pollay (1968) conducted a study on the child’s role as influencer in cereal purchase decisions. Since that time, several studies have examined children’s influence. It has been found that children exert varying degrees of influence on family decision processes and that children’s influence varies by product, child, parental and family characteristics (Mangleburg 1990).

Although these findings have been replicated across studies, the samples have largely been only in the United States. To date, few studies have examined the universality of these findings with samples from other cultures. This research begins to address this issue by developing research propositions for the study of urban Chinese children. In order to develop research propositions, the following procedure will be followed. First, a summary of the theory developed to date will be provided. This will be followed by a discussion of what variation is expected in urban Chinese families.

Product Decisions

Numerous studies of American children have shown that child influence on family purchase decisions varies by product. For example, Foxman and Tansuhaj (1988) studied the impact of product category and product importance on the relative influence of family members in purchase decisions. They found that children have more influence in the selection of products for which the child is a primary user or consumer. For example, research indicates that children are influential in the purchases of cereal (Belch et al 1985), vacations (Belch et al 1985; Jenkins 1979), toys (Burns and Harrison 1985), and movies (Darley and Lim 1986).

As with American families, it is expected that urban Chinese children will exert great influence on purchases of products for their primary consumption. A recent survey of urban Chinese families’ grocery shopping behavior revealed that children select almost half of the products bought, almost double the amount of influence typically accorded to American children. On average, an urban Chinese family was found to spend $1077 on groceries per year, $448 of which was determined by the child. The products with which children were shown to have a large amount of influence included beverages, snacks, and dairy products, all product categories in which children are the primary consumers (McNeal and Wu 1995).

In addition, it is expected that Chinese children will also have a large amount of influence on purchase decisions that affect the entire family. Research has found urban Chinese children to be influential in the selection of leisure activities for the family. Since the introduction of the long weekend, a decree by the Chinese government changing the workweek from 48 to 40 hours, and the change in the school week from 34 to 30 hours, families have had more leisure time. The choice of how to spend that time has been primarily left to the child (McNeal and Ji 1996). In fact, one study shows that children decide on leisure destinations in 80 percent of urban Chinese families (McNeal and Ji 1996). Another stdy, conducted in Beijing, found that children often selected restaurants on behalf of their families, with fast food restaurants often being the first choice (Yan 1999). Other evidence of the influence of children is implied by the amount of advertising dollars spent promoting directly to children. Asian Business magazine reports that in 1995, $13 million was spent in advertising targeted toward children aged 4 to 12. Thus, the following research proposition is suggested:

P1: Urban Chinese children will exert great influence in the selection of products for their own and their families’ consumption.

Decision-Making Processes

A number of studies have assessed American children’s influence on family decision processes. Across these studies, American children exerted the most influence during problem recognition and search stages (Szybillo and Sosanie 1977; Nelson 1978) and the least influence during the choice stage (Szybillo and Sosanie 1977; Nelson 1978; Belch et al 1985). In addition, children exerted little influence on the decisions of how much to spend (Szybillo and Sosanie 1977; Jenkins 1979; Belch et al 1985), where to go (Belch et al 1985; Jenkins 1979), and transportation mode (Jenkins 1979).